Buyers: Spring Season was a Snoozer. Will Summer be the New Spring? Sellers: Greater Phoenix is in a Balanced Market – What Sellers Need to Do

Spring time is typically the hottest selling market in the Valley. 2024 has so far been lackluster with lower than average demand and little inventory on the market. Still properties have continued to move pretty well. With news that interest rates may take a bit longer to come down, the market has shifted again to balance – meaning reluctant buyers will be expecting more out of sellers in terms of home condition and seller concessions. Hear what our smart economists at the Cromford Report have to say about each segment, and as we head into the summer months – let’s have a solid plan in place whether your goal is to buy or sell; there’s still opportunity out there in both camps.

For Buyers:

“So we keep waiting, waiting on the world to change.” ~ John Mayer

Mortgage rates have remained stubbornly high in 2024, continuing to suppress demand. As a result, the spring buying season was a dud this year for sellers. For active buyers, higher mortgage rates have led to less competition, fewer properties with multiple offers, accommodating sellers, more homes to shop in good condition, and a relaxed buying process.

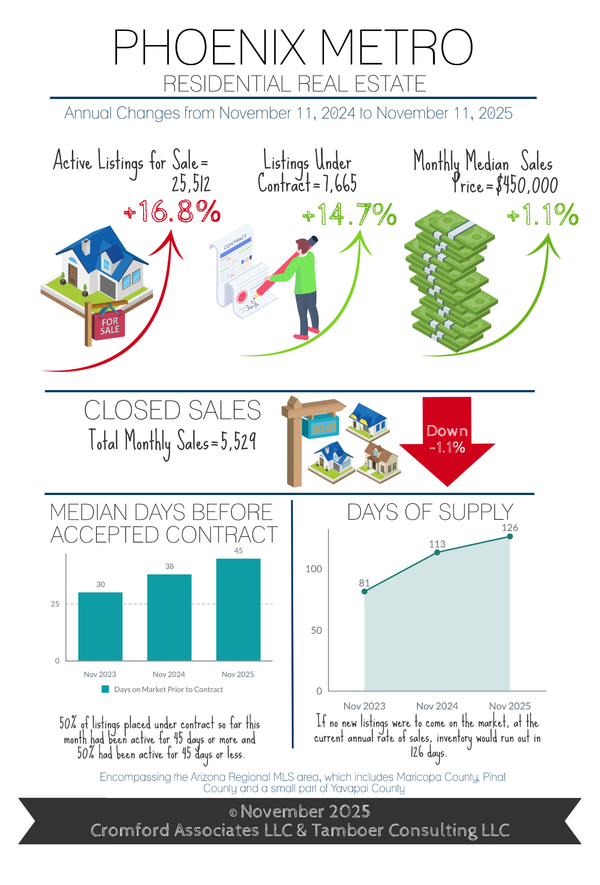

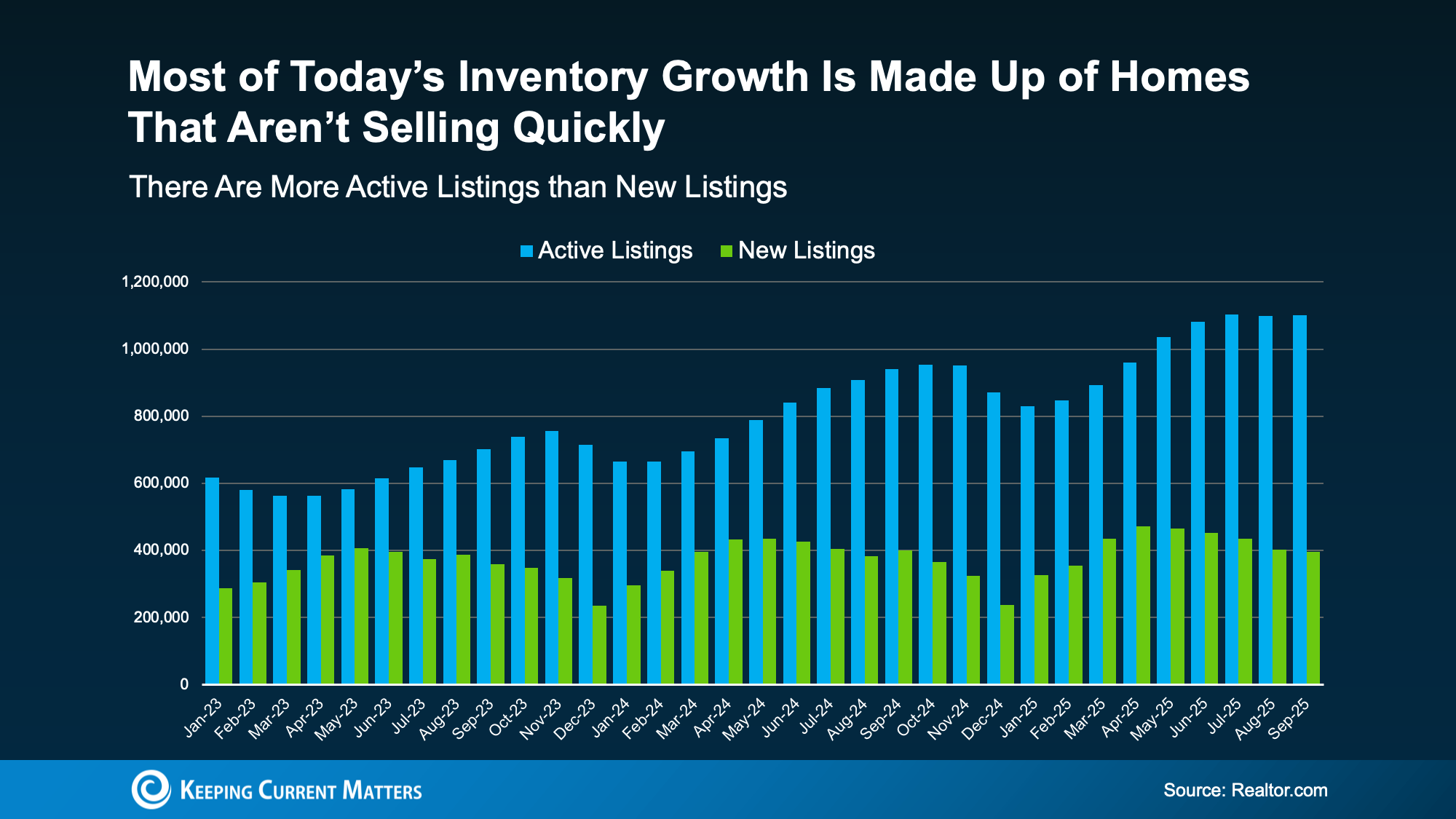

As supply gradually rises, new listings have lingered on the market 5 days longer than last year and weekly price reductions are up 63%. How long this condition will last is as predictable as mortgage rates, which have been volatile and unpredictable for 2 years. If they do in fact decline this year as expected, then buyer demand will return in kind. After peaking in April at 7.5%, average rates have already declined to 7.1% in response to a stabilizing job market. However, they’re still too high for the housing market to see a measurable shift in buyer demand. Recent history has shown a sustained increase in activity when rates have fallen below 6.5%.

Industry leaders and the Federal Reserve have expressed their expectation that rates will decline this year, with both Fannie Mae and the Mortgage Bankers Association predicting 6.4% by the end of 2024. If they are correct this time, then summer could be the new spring for home buying this year.

For Sellers:

The Greater Phoenix market is officially in a balanced state, which means the days of “dump your junk” are over for now. When there was little competition for sellers in 2021 and 2022, it was common for buyers to purchase homes in “as is” condition. These homes needed roof repairs, new A/C units, carpet replacement, paint, updating, and other renovations to bring them up to par, but they sold anyway with little effort due to the extreme market conditions.

By 2023, the seller’s market had weakened. Low supply meant properties in sub-par condition would still sell but with allowances for carpet, paint, negotiated repairs, and lower prices.

Now in 2024, most cities are either in a much weaker seller’s market, balance, or a full-blown buyer’s market. Supply is up 44% over last year and has reached a level similar to pre-pandemic 2017-2019. Supply is still 27% below normal, but it’s balanced out by demand that is also 20% below normal, suppressed by high mortgage rates.

Under these conditions the market has seen higher marketing times and an abnormal spike in cancelled listings. In a balanced market, it’s important to prepare homes for sale prior to listing and dismiss the idea that a buyer will accept a carpet allowance and credit for repairs over competing homes that are move-in ready. Buyers don’t want to choose their own carpet and paint. They don’t want to do repairs. It pays to take care of these items in advance prior to the first showing to reduce the time on market. As supply rises, the effort is not about increasing the sale price, it’s about ensuring it will sell at all.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report ©2023 Cromford Associates LLC and Tamboer Consulting LLC

Have questions about buying or selling a home in today’s market – reach out to me and let’s chat!

Recent Posts