Why Your Home Equity Still Puts You Way Ahead

If you’ve seen headlines about home prices dropping, it’s easy to wonder what that means for the value of your home too. Here’s what you really need to know.

Even with small price declines in some markets, data shows you’re likely still way ahead. And that’s thanks to your home equity.

The Relationship Between Home Prices and Equity

Home equity moves in sync with home prices. When prices rise, equity builds. When prices cool (even just slightly), equity growth does too. Here’s how that’s played out lately.

After the record-setting home price surge of 2020 and 2021, a little cooling was inevitable. Back then, the number of homes for sale hit a record low. That caused home values (and your equity) to shoot up significantly as buyers fought over limited inventory.

But prices couldn’t continue to rise at that intense pace forever. The market had to moderate at some point, and that’s exactly what we’re seeing right now. As more homes have come on the market this year, price growth slowed – so, equity gains did too. And that doesn’t mean you’ve lost ground.

Putting it into Perspective

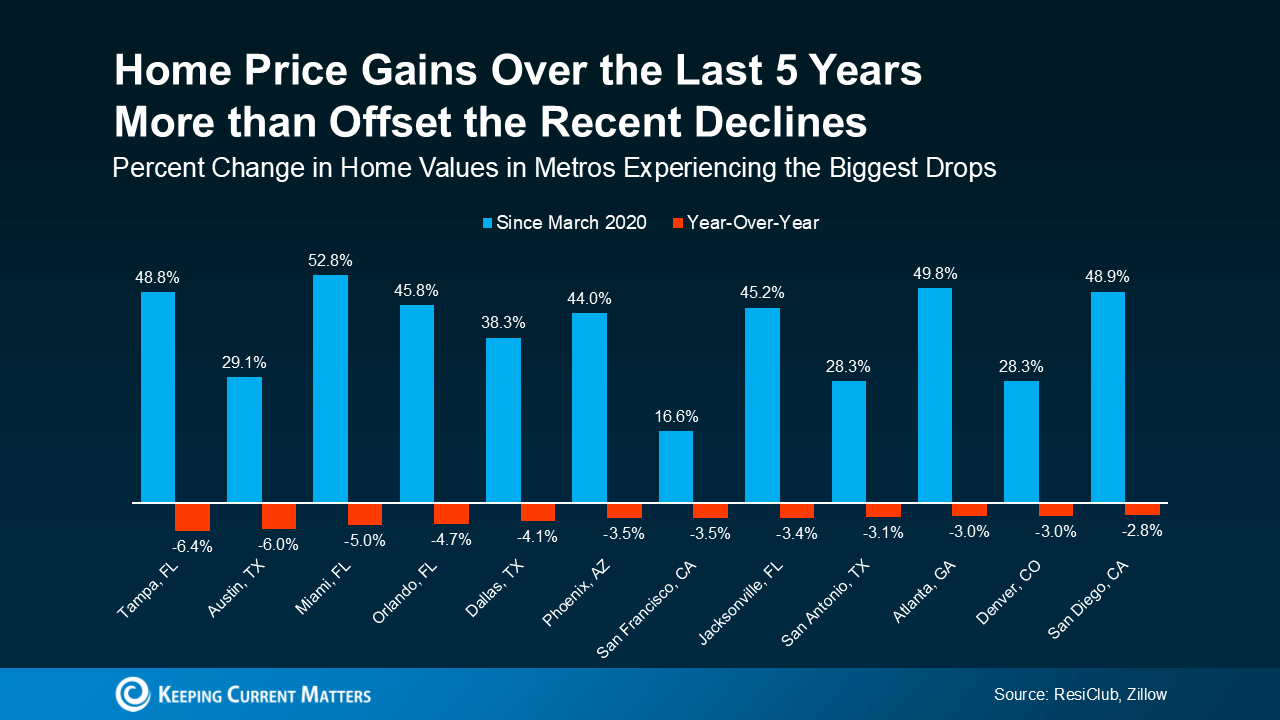

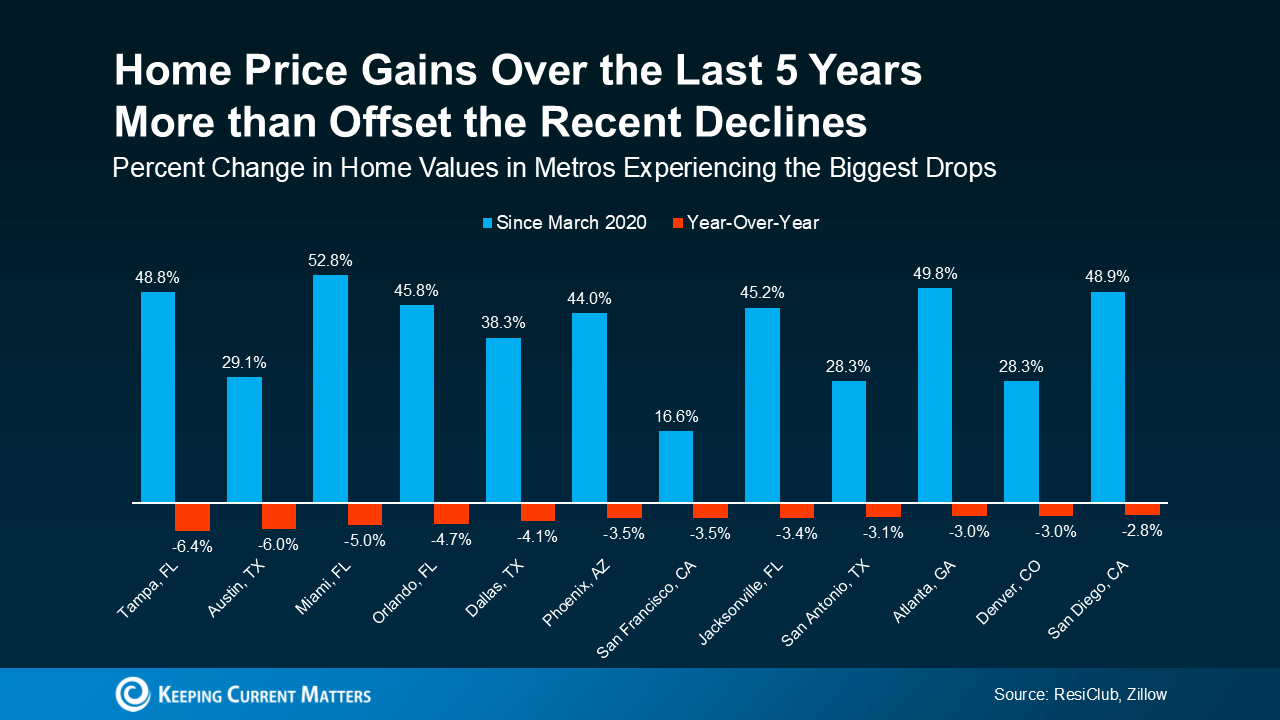

You probably still have far more equity than you did just a few years ago. And that puts you in a strong position if you want to sell. Here’s the data to prove it. According to research from Zillow, home prices have risen a staggering 45% nationwide since March of 2020. That’s a big jump.

And in the majority of markets, prices are still rising, just at a much slower pace. But even in the metros where prices are experiencing the biggest declines (the ones making the headlines), the average drop is only about -4%.

So, what’s that really mean? In most places, prices are on the rise, so this isn’t even a concern. But in the few metros where prices are cooling off a bit, the 5-year gains more than offset those small dips.

In other words, these modest declines can’t erase years of growth. Homeowners who’ve been in their houses for several years are still way ahead. Big time. And that’s true pretty much everywhere.

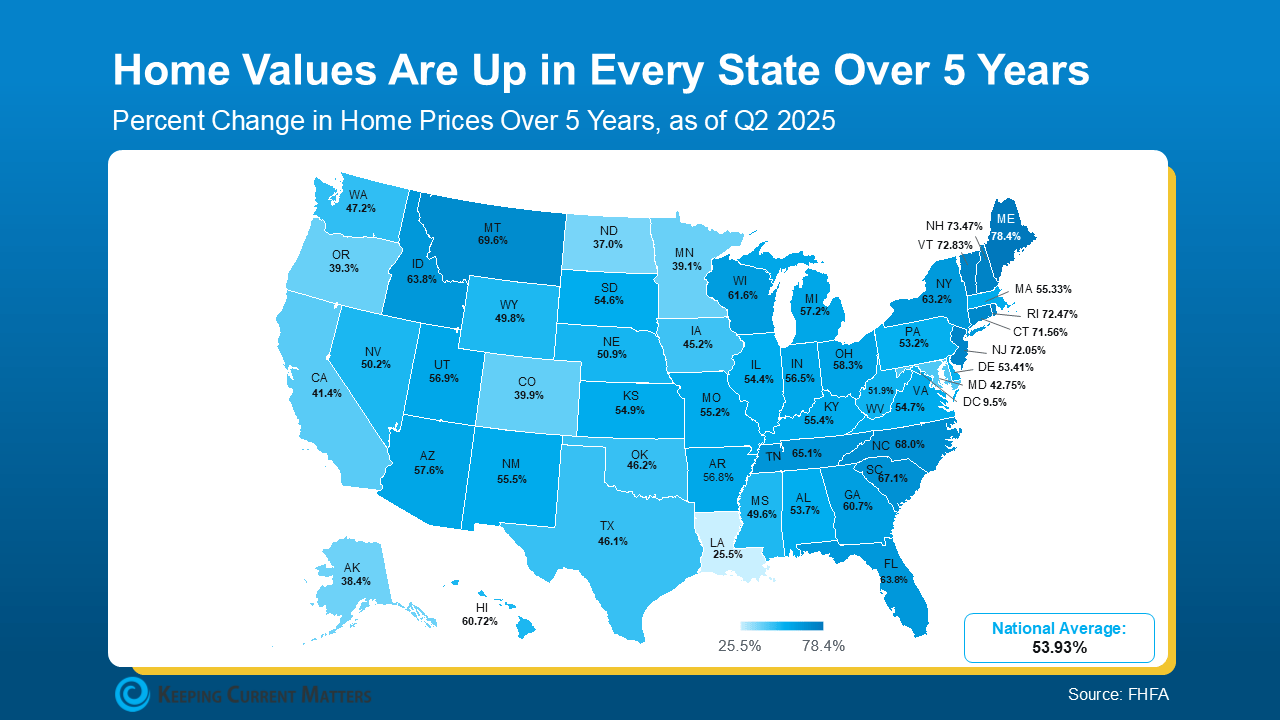

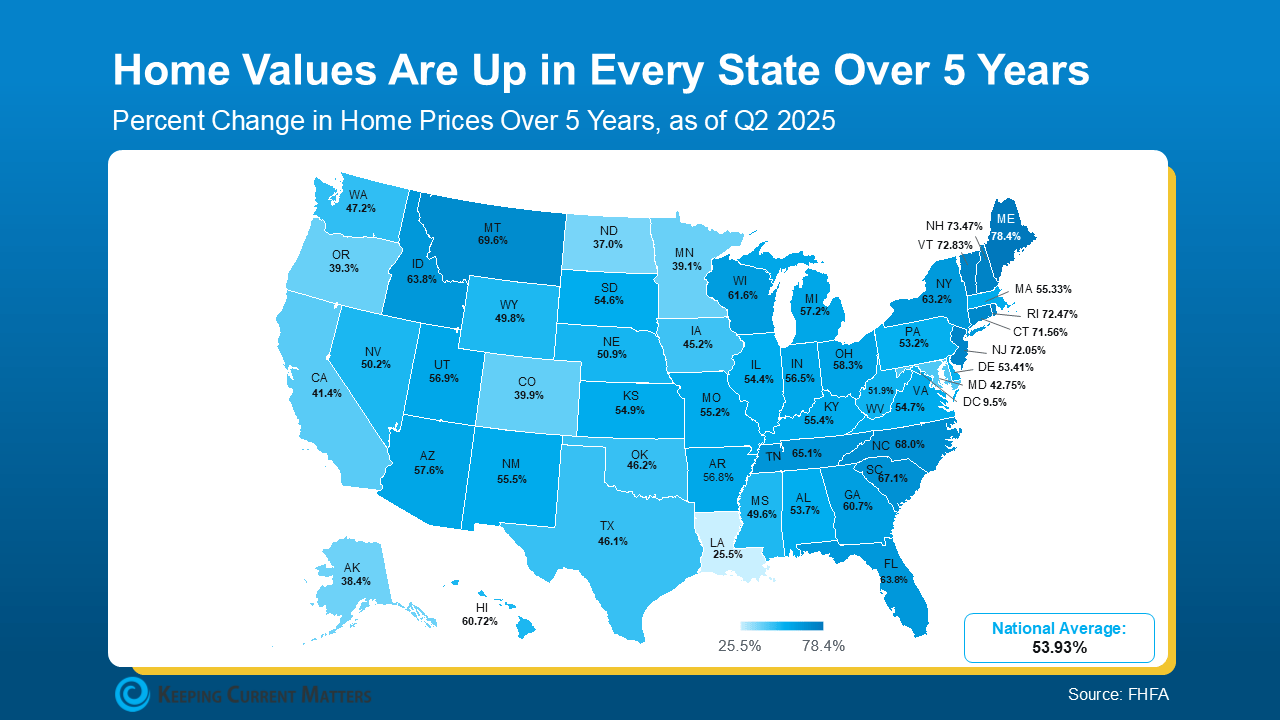

Data from the Federal Housing Finance Agency (FHFA) helps paint this picture. Let’s cast a slightly wider net and look at a state-by-state level this time. Every single state has seen prices go up over the last 5 years. And that means homeowners in each state have much more equity than they did just 5 years ago (see graph below):

Odds are, in most places, if you’ve owned your home for more than a few years, you’ve already built the kind of equity many people could only dream about before the pandemic. And if you sell, you can use it to help you downsize, or move up.

And just in case you’re worried prices will crash and your equity will take a bigger hit in the near future, here’s what Jake Krimmel, Senior Economist at Realtor.com, has to say:

“The slight recent declines in aggregate value and total home equity are not cause for concern . . . Although the market is coming into better balance, large price declines nationally are extremely unlikely in the near term . . .”

The price moderation we’ve seen lately isn’t a cause for concern. It’s a signal of a market that’s finding its balance again after several years of unsustainable price growth. And after several years of major price appreciation, most homeowners are still in an incredibly strong position.

Bottom Line

Even with prices easing in some areas, today’s homeowners are still holding on to near record levels of equity. If you’re curious about how much equity you’ve built or what your home could sell for in today’s market, let’s connect. Call or text 602-330-6813 to get a personalized home equity review with your reliable Phoenix Realtor who knows the local market inside and out.

Even with small price declines in some markets, data shows you’re likely still way ahead. And that’s thanks to your home equity.

The Relationship Between Home Prices and Equity

Home equity moves in sync with home prices. When prices rise, equity builds. When prices cool (even just slightly), equity growth does too. Here’s how that’s played out lately.

After the record-setting home price surge of 2020 and 2021, a little cooling was inevitable. Back then, the number of homes for sale hit a record low. That caused home values (and your equity) to shoot up significantly as buyers fought over limited inventory.

But prices couldn’t continue to rise at that intense pace forever. The market had to moderate at some point, and that’s exactly what we’re seeing right now. As more homes have come on the market this year, price growth slowed – so, equity gains did too. And that doesn’t mean you’ve lost ground.

Putting it into Perspective

You probably still have far more equity than you did just a few years ago. And that puts you in a strong position if you want to sell. Here’s the data to prove it. According to research from Zillow, home prices have risen a staggering 45% nationwide since March of 2020. That’s a big jump.

And in the majority of markets, prices are still rising, just at a much slower pace. But even in the metros where prices are experiencing the biggest declines (the ones making the headlines), the average drop is only about -4%.

So, what’s that really mean? In most places, prices are on the rise, so this isn’t even a concern. But in the few metros where prices are cooling off a bit, the 5-year gains more than offset those small dips.

In other words, these modest declines can’t erase years of growth. Homeowners who’ve been in their houses for several years are still way ahead. Big time. And that’s true pretty much everywhere.

Data from the Federal Housing Finance Agency (FHFA) helps paint this picture. Let’s cast a slightly wider net and look at a state-by-state level this time. Every single state has seen prices go up over the last 5 years. And that means homeowners in each state have much more equity than they did just 5 years ago (see graph below):

Odds are, in most places, if you’ve owned your home for more than a few years, you’ve already built the kind of equity many people could only dream about before the pandemic. And if you sell, you can use it to help you downsize, or move up.

And just in case you’re worried prices will crash and your equity will take a bigger hit in the near future, here’s what Jake Krimmel, Senior Economist at Realtor.com, has to say:

“The slight recent declines in aggregate value and total home equity are not cause for concern . . . Although the market is coming into better balance, large price declines nationally are extremely unlikely in the near term . . .”

The price moderation we’ve seen lately isn’t a cause for concern. It’s a signal of a market that’s finding its balance again after several years of unsustainable price growth. And after several years of major price appreciation, most homeowners are still in an incredibly strong position.

Bottom Line

Even with prices easing in some areas, today’s homeowners are still holding on to near record levels of equity. If you’re curious about how much equity you’ve built or what your home could sell for in today’s market, let’s connect. Call or text 602-330-6813 to get a personalized home equity review with your reliable Phoenix Realtor who knows the local market inside and out.

Recent Posts

Is January the Best Time To Buy a Home?

This May Be the Best Time To Buy a Brand-New Home

Why More Homeowners Are Giving Up Their Low Mortgage Rate

The 3 Housing Market Questions Coming Up at Every Gathering This Season

Why So Many People Are Thankful They Bought a Home This Year

Why Buying a Home Still Pays Off in the Long Run

How To Find the Best Deal Possible on a Home Right Now

The Top 2 Things Homeowners Need To Know Before Selling

Best Q4 for Contract Activity in 3 Years for Greater Phoenix | First-Time Homebuyer Payments are Down 13%-15%

The VA Home Loan Advantage: What Every Veteran Should Know Right Now