Best Q4 for Contract Activity in 3 Years for Greater Phoenix | First-Time Homebuyer Payments are Down 13%-15%

Q4 has started off favorably for both buyers and sellers here in the Valley. Interest rates, although still on a bit of a daily roller coaster have stabilized and are projected to continue to move down, spurring more buyers to the market which is a positive for seller's who have been struggling to get properties sold. As we head into the holidays, things will slow down as they normally do, but with future rate reductions in the works for January, post holiday season things should take off for sellers favorably. Take a read, and see what our smart economists at the Cromford Report have to say about each segment. If you're ready, let's put together a solid plan so we can get the most value for you no matter what your goal is: buying or selling.

For Buyers

It’s been an exciting month of November since President Trump floated the idea of a 50-year mortgage to help some buyers qualify to purchase a home. The initial reactions from the industry have spurred a healthy discussion on its potential impact on borrowers, affordability, demand. Since then, multiple ideas are circulating for new products that bring down payments without extending the term of the loan. It could get interesting!

For context, on a $400,000 loan at 6.25%, the PI payment on a 30-year is $2,463 and on a 50-year is $2,180, a difference of $283/month or 11.5%. But the cost of that savings is a much slower repayment of the loan. For example, after 3 years of payments a borrower would have paid down their loan by roughly $15,000 on a 30-year mortgage, but only $3,800 on a 50-year mortgage. It would take 9-10 years of payments to pay down the same 50-year mortgage by $15,000. This can create issues when it comes to pulling out an equity loan for expensive maintenance items like a new A/C unit or remodeling projects within 10 years of homeownership. That puts a lot of importance on annual appreciation to build equity.

The good news for first-time home-buyers looking under $400,000 is Greater Phoenix price measures have come down 10-14% from the peak of 2022, and 3-5% in just the last year alone. At 6.25%, mortgage rates are down from their peak of 7.25% at the beginning of 2025, and 0.5% lower than rates from last July, which has reduced the PI payment by 5-10%. Lower prices combined with mortgage rates down a full 1% puts payments down 13-15% over the course of the last year. This does not include the extra 20% off in the first year provided by temporary buydowns paid for by 60-70% of sellers in this price range. Supply of properties under $300K is up 39% over last year, prices are down 5%, October sales increased 21%, and new contracts are up 32% so far in November.

According to the Bureau of Labor Statistics, US wage growth has been outpacing the rate of inflation for 2 years now. Over the past 2 years, Greater Phoenix average hourly earnings have grown 12% while the concurrent CPI inflation rate for the area shows prices have only risen 3.3%. This growth combined with home prices coming down in the most affordable price ranges mean that a 50-year mortgage may not be needed to bring affordability measures into a manageable range. They may already be there for a growing number of buyers.

For Sellers

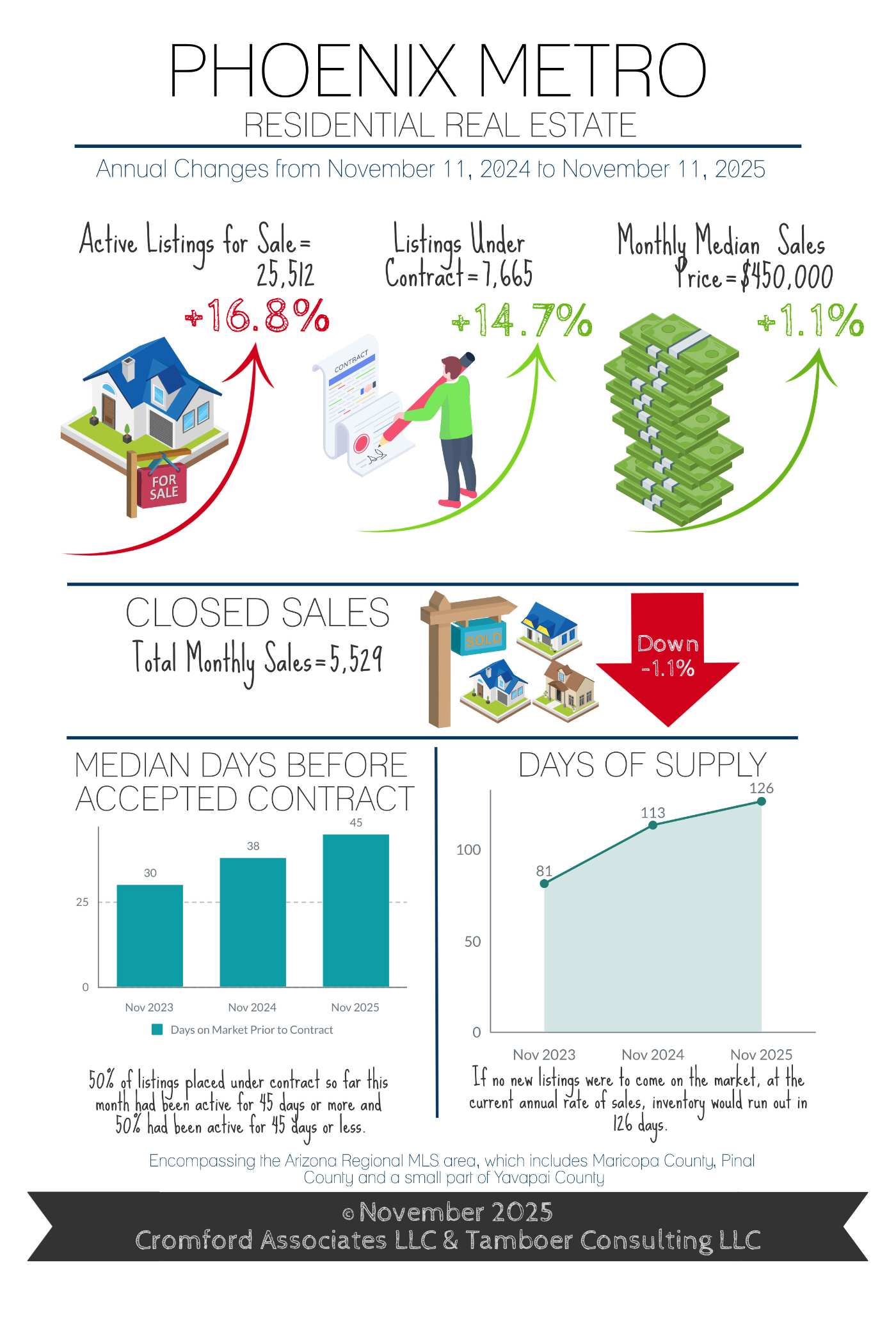

It took a while for the buyers to mobilize, but better late than never. So far, this is the best 4th quarter Greater Phoenix has seen in 3 years for contract activity. Listings under contract are up 15% over last year with notable improvements in the market under $300K and the market over $1M. The government shutdown didn’t help closings for FHA and VA transactions, especially between $300K-$600K, but October saw a 3.3% increase in sales regardless, and closings delayed will add to the November sales counts.

The Federal Reserve met on October 29th and announced a 0.25% decrease in the Federal Funds Rate and the end of the reduction of their securities holdings as of December 1st. This is one more step towards easing up on quantitative tightening and should be stabilizing for future mortgage rates. That is good news for sellers.

In the meantime, stock market performance, corporate profits, and cryptocurrency have performed well enough to boost the luxury market in Q4. Contracts in escrow between $1M-$2M are up 25% over the past 5 weeks, and up 16% over last year. Contracts in escrow over $2M have risen 25% over the past 9 weeks putting them up 7% over last year. It hasn’t been enough to boost contracts in retirement communities much, but Sun City, Sun City West, and Sun Lakes are not doing worse than last year.

Contract activity typically drops after the Thanksgiving holiday until the new year begins. This sparks a wave of price reductions just before Thanksgiving followed by just a trickle of reductions in December. January is the most popular month for new listings to hit the market, so properties that don’t sell between now and December should expect another wave of price reductions in the first few weeks of January.

Overall, while demand is slowly improving, supply is still on the rise and keeping most cities in a balanced or buyer’s market. Prices are still under pressure and buyers are looking for the best value for their budget. Competition and negotiations can get fierce in December, especially in those areas competing with new home subdivisions.

Commentary written by Tina Tamboer, Senior Housing Analyst with The Cromford Report

©2025 Cromford Associates LLC and Tamboer Consulting LLC

Have questions about buying or selling a home in today's market - reach out to me and let's chat! Reach me at https://linktr.ee/brianeastwoodrealtor. It can be overwhelming, but I’m here to help! |

Recent Posts